10 African countries with investment opportunities in Africa

If you are warming up to the idea of investing in Africa, then the next question on your mind would probably be, ‘where is the best place to do business in Africa?’

Here are the ten best African countries to start a business.

Egypt

- One of the best places to do business in Africa is Egypt. Though it was one of the hardest hit African countries during the Covid pandemic, it was also one of the first African economies to bounce back. Thanks mainly to the government’s swift implementation of economic measures.

- Moreover, Egypt’s geographical proximity to the Middle East and Europe lends it a territorial advantage.

- Other potentials of Egypt that private investors should look at are the incredible pool of talent, high population, affordable cost of living, and cheap real estate. There is also a second citizenship possibility for a Tier-C passport.

- Economists are optimistic that the GDP will reach a 3.8 percent increase by year-end. Furthermore, Egypt is also expected to expand its economy by 5.20 percent in 2023.

Morocco

- Another place to invest in Africa is Morocco. This African country enjoys a relatively stable political system that directly translates to its sturdy economy. Better, in fact, than any country in sub-Saharan Africa.

- The Moroccan government enjoys closer ties with Europe but also sees the potential for diplomatic relations with other African countries. The country has reintegrated into the African Union and is working towards membership in the Economic Community of West African States (ECOWAS).

- Last year, the Moroccan economy experienced a 7 percent increase in GDP. The increase is attributed mainly to the agricultural sector. However, the government expects a slowdown in the economy and forecasts a 3.2 percent economic growth for the next couple of years.

South Africa

South Africa is probably the most popular place to invest in Africa. It has received the lion’s share of direct investment in foreign stocks in the whole African continent because of its developed market. Thanks predominantly to its sound economic policies, mature capital market, and availability of financing services. Add to that are the established land infrastructure and ports that facilitate the transport of goods and services.

Businesses in South Africa are marked by a robust manufacturing industry and retail market. Thus retail remains a great business opportunity for expansion. As a result, companies in South Africa remain optimistic despite a lower GDP forecast of 1.3 to 1.8 percent for the next two years.

Rwanda

Despite its small size, Rwanda is one of the best countries to invest in Africa and is one of the fastest-growing economies on the African continent.

Rwanda has become one of the African emerging markets, making an impression on private equity firms, venture capitalists, multinational companies, institutional investors, and even local business leaders.

Though this African market has limited expansion opportunities, foreign direct investment continues to pour in because of the sound business environment. In addition, good governance and effective economic policies all add to Rwanda’s desirability for African stocks.

Rwanda’s domestic market is also a gateway for investors looking to enter other east African markets. Trade opportunities to watch out for are in the construction and energy sectors.

This year, African Development Bank forecasts a 6.9 percent increase in GDP for Rwanda, following double-digit growth in the previous quarters.

Botswana

Botswana has one of the strongest economies to invest in Africa, with great potential for development.

As the least indebted country in Africa, Botswana has high foreign exchange reserves thanks to the Pula Fund. Pula Fund is the long-term investment portfolio of Botswana from preserving part of the revenues from diamond export. This sovereign fund helped lessen debt exposure by financing the majority of the budget deficit caused by the pandemic.

Botswana is desirable for high-net-worth individuals looking to invest in the region because of the low level of corruption and ease of doing business. It is also a high English-speaking country.

The leading enterprises for big multinationals and investors to consider are food processing, textile, and mining.

Botswana’s economic growth forecast for the next two years is at 4 and 4.20 percent, respectively.

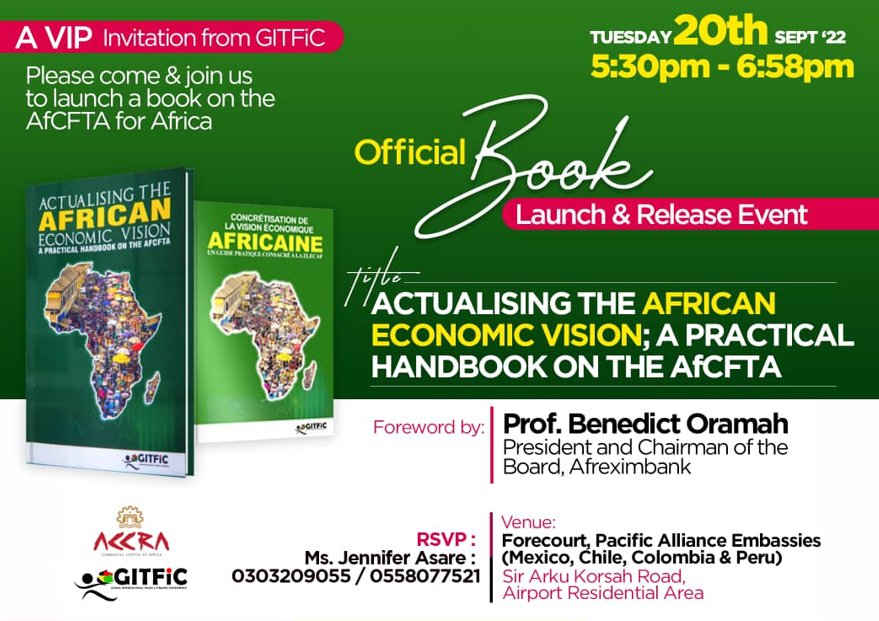

Ghana

Ghana is another country to consider if you want to invest in Africa. Ghana has experienced significant shifts over the past years because of its largely commodity-dependent economy. This poses a double-edged sword: it provided a firm footing before the pandemic but was crippled when demand slowed. However, moving forward, Ghana is positioned for significant growth as economies pick up.

Sectors to watch out for gold, cocoa, and oil. The World Bank forecasts a 5 percent GDP increase this year.

Mauritius

Mauritius is best known for two things: its tax-friendly environment and its sugar products.

Though the agriculture sector is essential, investors would be happy to note that Mauritius is diversifying its economy. Financial services, textile, exports, and tourism are being developed to lessen the country’s dependence on sugar production. Therefore, an institutional investor should look at the country’s financial sector for opportunities—specifically, cross-border investment activities and banking services.

Mauritius’s projected GDP increase is at a low but steady 1.5 percent.

Côte d’Ivoire

One of Africa’s underrated emerging markets, Côte d’Ivoire, has enjoyed a robust and stable economic expansion for the past decade.

The global pandemic interrupted the growth, though the economic forecast remains positive. Domestic demand for consumer goods, services, and exports lead the country’s path to economic recovery.

The government’s thrust on infrastructure projects coupled with a relatively stable political and business sector all add to the economic development in the region.

Investment in infrastructure projects from public and private investment funding continues to drive interest among venture capitalists and private equity firms.

Other sectors to watch out for in Côte d’Ivoire are construction, manufacturing, agriculture, transportation, and energy will drive foreign direct investment.

Côte d’Ivoire’s economy is projected to grow by 6.3 percent this year and a further 6.6 percent increase by 2023.

Kenya

If you want to test the waters of the African market, Kenya will be an excellent place to invest.

This East African country is Africa’s economic, commercial, financial, and logistic hub. They are driven primarily by young entrepreneurs in technology–specifically the fintech segment. Moreover, startup enterprises with social impact in mind are a hit among foreign investors.

Multinational companies looking to offshore their business or expand their operations in Africa should consider this African nation.

Kenya’s economic growth forecast is at a robust 5.5 percent and will continue at 5.2 percent till next year.

Tanzania

Tanzania’s 10th place is attributed mainly to the economic slowdown in the country’s changing business policies. However, government investment in the energy, telecommunications, and finance sectors helps keep the economy afloat.

But as one of Africa’s emerging markets, institutional investors keep a favorable forecast for African investments. Foreign direct investment opportunities in the mining, tourism, and telecommunications sectors remain attractive if you want to invest in Tanzania.

Tanzania’s economic growth is at 4.7 percent for this year and 5.3 percent for the coming year.

Credit: GITFiC.com (2023 Investment index compilation)